Radiology practices, regardless of how they handle their billing, all have the same goal in mind: to create a claim and have the insurance company process it as quickly as possible and receive the appropriate reimbursement per their contract. This ensures the practice has the necessary cash flow to maintain its operations and keep excess billing and operational costs at a minimum.

Unfortunately, some claims are denied by payors for a myriad of reasons. This shifts the financial burden back on the patient and as one might imagine, is not optimal for the patient or the practice.

But is there a way for radiology practices to optimize denial management and receive quicker payments to improve their cash flow? This article will take a deeper look into denials, list common reasons why claims are denied, and provide tips on how radiologists and their staff can reduce their denial rate.

What is a denial?

When a claim is submitted, it goes through a claim edit or verification process. This process functions to verify the accuracy, validity, required presence, format, consistency, allowable values, integrity, and completeness of all data submitted.

A denial is a response where a payor determines a claim does not meet coverage criteria. The claim is marked “unpayable” and results in slowed payments, partial payments, reduced payments, or even zero payments.

A denied claim is different from a rejected claim (soft denial), which is typically caused by a technical error that fails to get through a front-end edit. Front-end edits are performed by the billing system and/or the clearinghouse. The payor never processes the claim, so the claim isn’t technically denied.

For both, a denied claim or a rejected claim, the billing operation and/or radiology practice will need to correct the issue. Still, a denial causes much more of a headache because the staff must now take considerable time to review and research the claim to correct and resubmit, as well as determine the root cause of the denial.

What are the most common reasons why claims are denied?

There are quite a few reasons why a payor can deny a claim, and the list has grown exponentially over the years as policies and procedures have become more confusing and complicated. A health insurer could deny your claim for any of the following:

⮞ The insurer’s medical payment policies: medical necessity, pre-existing condition, non-covered benefit, or out-of-network provider

⮞ Incorrect Health Insurer information

⮞ Missing CPT Codes, physician, or patient identifiers

⮞ Lack of referral, authorization, or enrollment and eligibility information

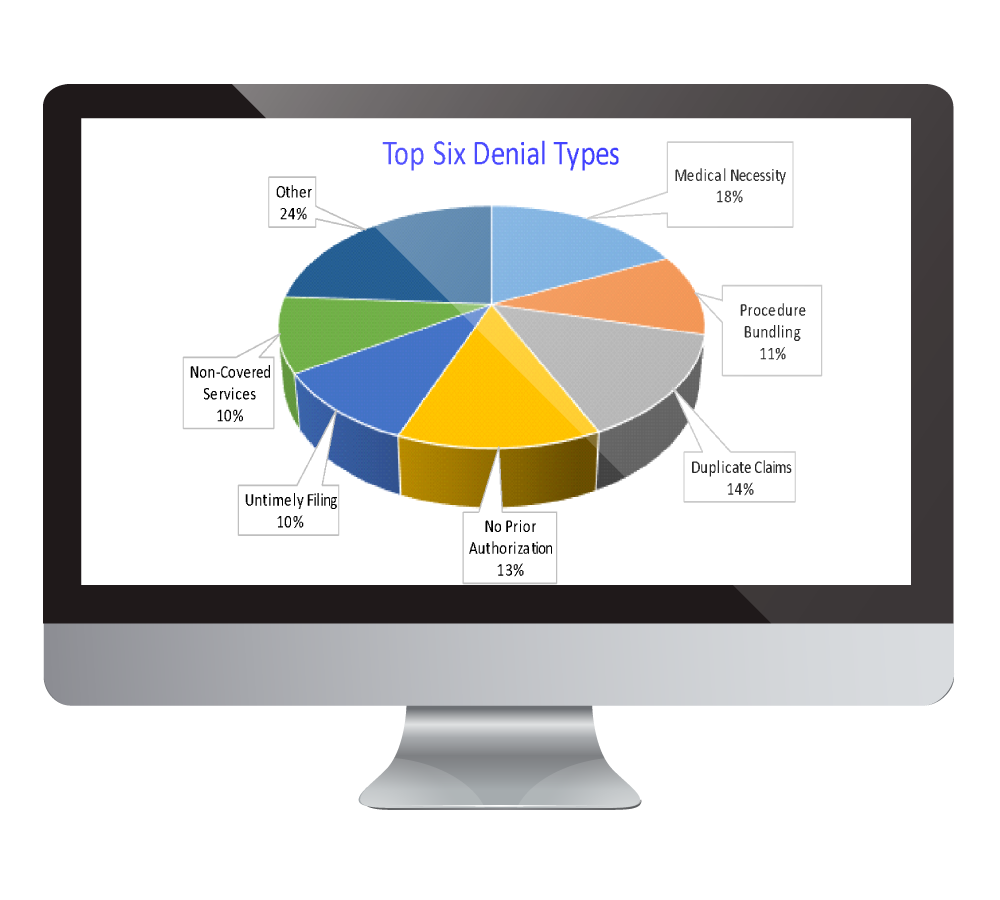

According to the Radiology Business Management Association (RBMA), the top six reasons for denials are due to medical necessity, duplicate claims, no prior authorization, procedure bundling, untimely filing, and non-covered services.

How often are claims denied in the radiology industry?

The claim denial rate in the radiology industry will vary significantly among individual practices, various hospitals and private insurance versus Medicare and other government-sponsored healthcare plans.

The following two charts show denial rates within the industry and the percentage of claims denied by payors.

It’s essential to keep in mind that payors are constantly changing their claims rules and implementing new technologies, making their claim adjudication procedures more complex. This has led to increased denials, lengthy processing times, and more confusion on correcting issues and resubmitting claims. That’s why it’s so important to mitigate errors before they reach the payor whenever possible.

What are the benefits of reducing denials?

Rejections and denials are a part of the revenue cycle management (RCM) process. Still, third-party billing companies and internal billing departments do have control over their internal processes to prevent rejections and resolve denials quickly and efficiently before the payor’s deadline.

Did You Know?

- ⮞ 90% – 93% of rejections are preventable data entry errors

- ⮞ 70% of denials can be successfully appealed and paid

In a moment, we will share seven ways how your practice can resolve denials and get paid in full for your services.

Practices that reduce bottlenecks or inefficiencies in their management of denials and rejected claims can experience a wide range of benefits, including the following:

Accelerated Payments

Lower Processing Costs

Improvements to the Accounts Receivable, AR Days, and Aging Receivables

Decreased FTE Staffing in the Billing Department [if Your Practice Handles the Billing Internally]

Fewer Write-Offs

Improved Collections

How Radiology Practices Can Resolve and Even Prevent Denials

The Resolution Process

MBMS’s goal is to empower your practice to take active steps to submit clean claims and resolve denials as quickly as possible. Your workflow provides the framework your MBMS dedicated billing team needs to determine the root cause of any denials and show how to resolve the issue so you can resubmit the claim.

Here is a sample framework that addresses many of the challenges inherent in a complex payor reimbursement system with constantly changing policies and procedures:

- ⮞ Review radiology report for additional (CPT or ICD-10) coding to support services (Not Medically Necessary denials)

- ⮞ Review payor policies/local coverage determinations (LCD)

- ⮞ Review Medically Unlikely Edit (MUE) and National Correct Coding Initiative (NCCI) edits

- ⮞ Access patient records for insurance updates or additional clinical/diagnostic information

- ⮞ Resubmit corrected claim with updated documentation

- ⮞ Observe payor instructions for appeals to avoid duplicates

An efficient billing and follow-up workflow may include grouping claims by payor, denial type, and provider as this will help your team identify trends that contribute to A/R delays and work on similar claims together to reduce processing time.

As every organization is different, you might have a slightly adjusted resolution process, but it should ensure your team has the structure and support to resolve any denied claims.

Seven Ways to Reduce Denials

Your resolution process will be your guide to correcting and resubmitting denials. It will help your practice receive reimbursement for the services you provide if the claim is denied. But what if you could reduce your denials and submit more clean claims the first time around? It is possible, and MBMS experts have outlined seven ways you can improve your denial rate.

-

Historically, nearly one-third of patient registrations have included serious demographic errors. When you verify all demographic data prior to service, downstream processes improve, making it more likely that your claim will be approved, and you will receive appropriate reimbursement. An organized validation system will also reduce fraud.

-

A large percentage of denials are due to eligibility issues and payor practice data discrepancies. It is essential to train the billing staff in how to correctly determine eligibility upfront during scheduling and registration prior to service. This can be done by telephone or the payors’ websites. You could also use an automated third-party service provider, but transaction fees will apply. It may be appropriate if there are staffing issues and eligibility verification cannot be performed.

-

The financial impact of improperly obtaining service authorizations can be significant, from reduced reimbursement to, in many cases, a complete write-off of an account. Having a process in place for determining when pre-authorization is or is not required can reduce administrative back-office costs significantly and improve operational inefficiencies, like staff members having to spend hours on the phone with payors.

-

A high percentage of claims are rejected due to “basic” data incorrectly gathered during registration. These inaccuracies remain the number one cause for claims being rejected or denied. Inaccuracies or changes in insurance mapping can also affect claim processing. Your third-party billing company or internal billing department should pay close attention to all critical data elements and be aware of the most common errors concerning data elements. They include the following:

- Patient name on a claim not matching patient name on file with the payor

- Incorrect or missing Member ID Number

- Coordination of Benefits (COB) information

- Claim submitted to the wrong payer (direct Medicaid vs. commercial Medicaid)

-

In addition to verifying information to ensure every data element of the claim is analyzed, many third-party billing companies and internal billing departments choose to work with a claims clearinghouse to provide an intricate cleaning of the claim prior to submitting it to the insurance payor. Scrubbers verify that a procedure performed is associated with a diagnosis code that justifies the medical necessity of that procedure along with variables such as gender, age, date, place of service, and any required modifiers.

Did You Know?

Multiplying the total number of Medicare local and national coverage determinations, with data from the Correct Coding Initiative (CCI), ICD-10 codes, and modifiers, there are over a million potential scenarios of editable combinations.

-

Review your third-party billing company or internal billing department’s revenue cycle policies and procedures regularly to ensure it reflects best practices and updated payor rules. Here are some things to look for when conducting your periodic review:

- Proper linkage between diagnosis (ICD-10) and procedure codes (CPT)

- Current year codes

- All providers have proper payor credentials

As you review and optimize your revenue cycle for effectiveness and efficiency, you might find that it’s a good idea to develop a well-documented standardized claim correction process by denial type.

This will allow your third-party billing company or internal billing department to identify trending issues by payor, collect accurate documentation on all payor policies, verify demographic tables routinely, and track preventable denials back to the source for a permanent fix. These functions should help you reduce future denials.

-

Whether you choose to maintain an internal billing department or partner with a third-party billing company, there are certain qualities and credentials your team needs to have to be successful.

- Highly experienced, certified (RCCB, RCCIR, and/or CPC) coding and billing professionals, specific to radiology

- Up-to-date on CMS and Medicaid options for MIPS bonuses and strategies to avoid penalties

- Ability to audit your coding and documentation

- Strong working knowledge of the ongoing changes in codes, medical policies, and industry-specific information

- Fluency in the complexities of Medicare, Medicaid, Workers’ Compensation, and commercial carriers

A Final Note about Denial Management in Radiology

As you have likely surmised from reading this article, denial management is complex, requires nuance, and is challenging to master as rules and procedures change and grow more complex. Many times, it makes sense to turn to specialists who can help you turn denials into payments.

As a radiology-specific third-party billing company, MBMS has developed industry-unique reporting and analytic tools to research and resolve denials. MBMS maximizes its clean claim rate upfront by staying on top of the latest denial trends and payor rules.

Contact MBMS today to schedule a demo of Discover®, MBMS’s web-based business intelligence tool for denial management reporting. Learn more about how MBMS helps radiology practices maximize their revenue cycle performance.